The steel industry is currently being affected by Russia’s ongoing invasion of Ukraine and its myriad of knock-on effects. Coming directly after the first couple of years of the pandemic, the level of unrest has been reflected in steel prices.

Over the last 18 months, steel prices have increased by a huge 65%. Much of this increase occurred after Russia’s February 24 invasion of Ukraine. As a big global producer of steel, Russia has seen supply disruptions following economic sanctions imposed by the rest of the world. In the week after the conflict began, global steel prices sharply rose by 20%.

The inflation rate in February 2022 hit a high of 7.9%, a level not seen since 1982.

What is the effect of the increase in global steel prices?

Neerav Parmar, vice-president of the Builders Association of India, has lamented the increase in the cost of acquiring steel for construction:

“Our margins will be squeezed considerably. In the case of government projects, contractors will suffer heavily”.

Neerav Parmar, Vice-President of the Builders Association of India

Everyone who needs to buy steel is set for a tough time with the inflated prices, but producers of steel might be set to gain from exporting steel globally. Domestic prices remain lower than global ones, so countries which export steel internationally could be in for increased margins.

In fact, V.R. Sharma, managing director of Jindal Steel & Power Ltd., has said that “there is a net advantage of $200-$250 per ton” when exporting steel to Europe, the Middle East and North Africa. During the current supply shortage, these regions are lacking around 3 million tonnes of steel per month. Indian producers like Jindal Steel & Power Ltd. are set to profit from higher global steel prices and increased demand.

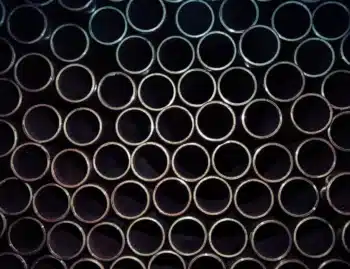

Contact Federal Steel Supply today for our most up-to-date steel pipe and tube pricing or request a custom quote.

What are the effects in the U.S.?

As mentioned in The Fabricator, the USA is also set to experience major effects of the inflation in steel prices. As with the pandemic, the USA might be hit by the effects with a short delay from Europe and the rest of the world. This is because the Americas are not as reliant on Russia and Ukraine for steel as European countries are.

However, prices were already starting to shift in March 2022. Nucor announced a price increase of $100 per ton of steel at the start of the month. This follows a sequence of decreasing or flat prices going back to September 2021. Alongside steel, The Fabricator forecasts a sharp rise in the price of iron, oil, natural gas and electricity. Any current inventory should be used wisely, because buying steel into the future is going to be a volatile experience.

How else is the Russia/Ukraine conflict affecting the steel industry?

Putting the increase in steel prices to a side, the global increase in fuel prices is one factor contributing to a large number of steel workers quitting their jobs. Metal factories, such as BCI Solutions in Bremen, Indiana, have seen a decrease in their workforce. In fact, BCI has seen 7% of their workforce leave in March alone.

The CEO of BCI has mentioned that the rise in fuel prices following the Russia/Ukraine conflict has led to a large percentage of the workforce wanting to work closer to home to avoid spending so much on filling their cars.

With a potential economic recession on the horizon, combined with a shortage in supply of steel and an agitated workforce, the steel industry is set to navigate tricky times in 2022 and beyond.